Share

17th February 2016

09:07pm GMT

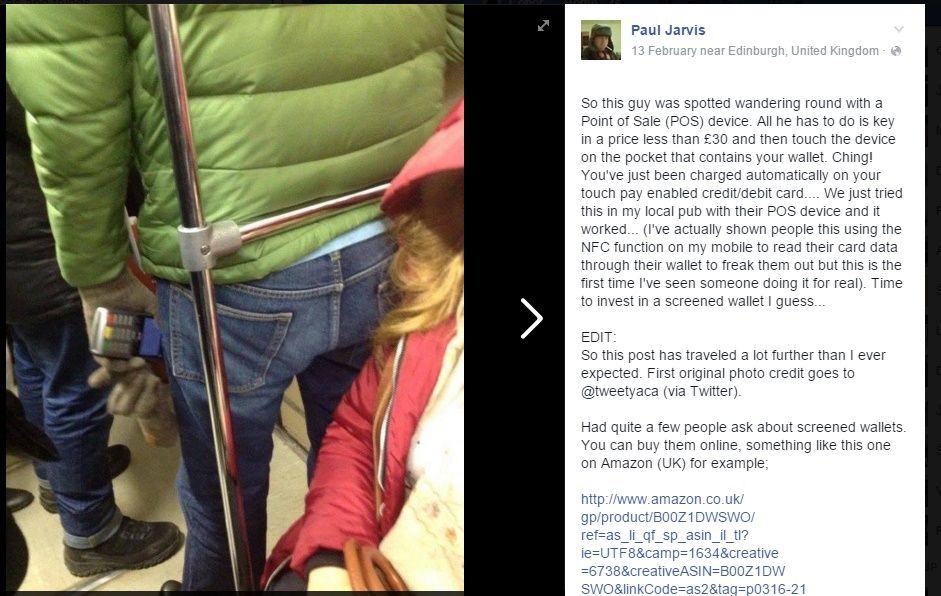

Aware of this, the man in the picture was keying in prices of below £30 and touching them against the pockets of people where their wallets were contained.

Screened wallets would prevent somebody from using such a method to scam people of money from their cards and it could only really be used in crowded places, but as Jarvis points out in his Facebook post, it is possible.

Aware of this, the man in the picture was keying in prices of below £30 and touching them against the pockets of people where their wallets were contained.

Screened wallets would prevent somebody from using such a method to scam people of money from their cards and it could only really be used in crowded places, but as Jarvis points out in his Facebook post, it is possible.

Here's Jarvis' Facebook post in full:

So this guy was spotted wandering round with a Point of Sale (POS) device. All he has to do is key in a price less than £30 and then touch the device on the pocket that contains your wallet. Ching!

You've just been charged automatically on your touch pay enabled credit/debit card.... We just tried this in my local pub with their POS device and it worked... (I've actually shown people this using the NFC function on my mobile to read their card data through their wallet to freak them out but this is the first time I've seen someone doing it for real).

Time to invest in a screened wallet I guess...

VISA, meanwhile, have taken steps to reassure customers with the statement below.

"Since the introduction of contactless payments a number of years ago, card fraud has remained at historic low levels.

"The vulnerabilities claimed in this post would in reality be extremely difficult to undertake – not least because the fraudster would need to be very close to the cardholder and behave in a way likely to arouse suspicion. Additionally, there are multiple layers of security in place to block suspicious transactions so the potential reward for undertaking such a risky fraud would be low.

"If a consumer is a victim of fraud, they should contact their issuing bank immediately. Consumers who have been defrauded on their contactless cards receive the same level of protection from their bank as they would with any other Visa transaction."

Cheers to the girls at Her.ie for their help with this one.

Here's Jarvis' Facebook post in full:

So this guy was spotted wandering round with a Point of Sale (POS) device. All he has to do is key in a price less than £30 and then touch the device on the pocket that contains your wallet. Ching!

You've just been charged automatically on your touch pay enabled credit/debit card.... We just tried this in my local pub with their POS device and it worked... (I've actually shown people this using the NFC function on my mobile to read their card data through their wallet to freak them out but this is the first time I've seen someone doing it for real).

Time to invest in a screened wallet I guess...

VISA, meanwhile, have taken steps to reassure customers with the statement below.

"Since the introduction of contactless payments a number of years ago, card fraud has remained at historic low levels.

"The vulnerabilities claimed in this post would in reality be extremely difficult to undertake – not least because the fraudster would need to be very close to the cardholder and behave in a way likely to arouse suspicion. Additionally, there are multiple layers of security in place to block suspicious transactions so the potential reward for undertaking such a risky fraud would be low.

"If a consumer is a victim of fraud, they should contact their issuing bank immediately. Consumers who have been defrauded on their contactless cards receive the same level of protection from their bank as they would with any other Visa transaction."

Cheers to the girls at Her.ie for their help with this one.Explore more on these topics: